Mountain West Financial Closes Wholesale Channel. Are They Another Victim Of The UWM Juggernaut?

You can add Mountain West Financial to the list of lenders unable to compete with the juggernaut of United Wholesale Mortgage.

You can add Mountain West Financial to the list of lenders unable to compete with the juggernaut of United Wholesale Mortgage.

The California-based company informed its broker network last week that it has “made the difficult decision to take a step back from wholesale lending,”

Mountain West Financial will continue to sell FHA, VA and USDA loans to retail clients throughout the Western United States.

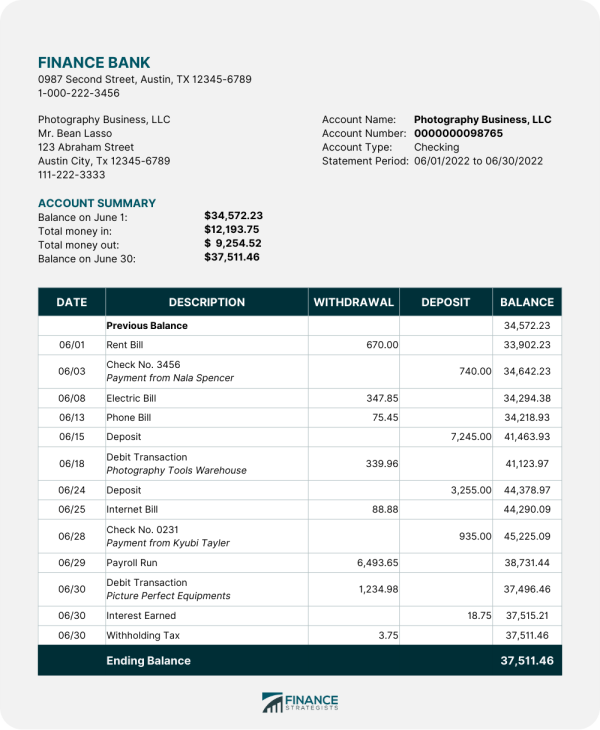

The lender claims it originated $1.9 billion in 2021. The company also says it wholesale operations comprises 33% of the total. Company the company reached $437.5 million in total volume in the first half of 2022. The also said wholesale originations were responsible for 33%.

Mountain West also stated they will honor all loans in the pipeline that were locked by August 26th. However, all loans must be closed by September 30th. The company did not provide any reasons for the decision.

Mountain West Financial Couldn’t Compete In A Changing Market

The company faced reduced origination volumes because of higher interest rates and an unstable housing market. In addition, the price war initiated by United Wholesale Mortgage contributed to the decision.

UWM’s price war in a downsizing economy has caused several weaker wholesale players to close or exit the wholesale market all together.

UWM pledged to beat the top 20 lenders’ pricing by one basis point in May. In June, the company took another aggressive step towards pricing with the ‘Game On’ pricing initiative, slashing prices across all loans by 50 to 100 basis points.

Mat Ishbia’s initiatives seem to be working for UWM. UWM has seen a 55% increase in profits since the beginning of the year. The company has not laid off employees. Most importantly, Ishbia’s initiatives are increasing UWM’s market share beyond anyone’s expectations. The initiatives are also wreaking havoc on their competitors who are already suffering from compressed margins.